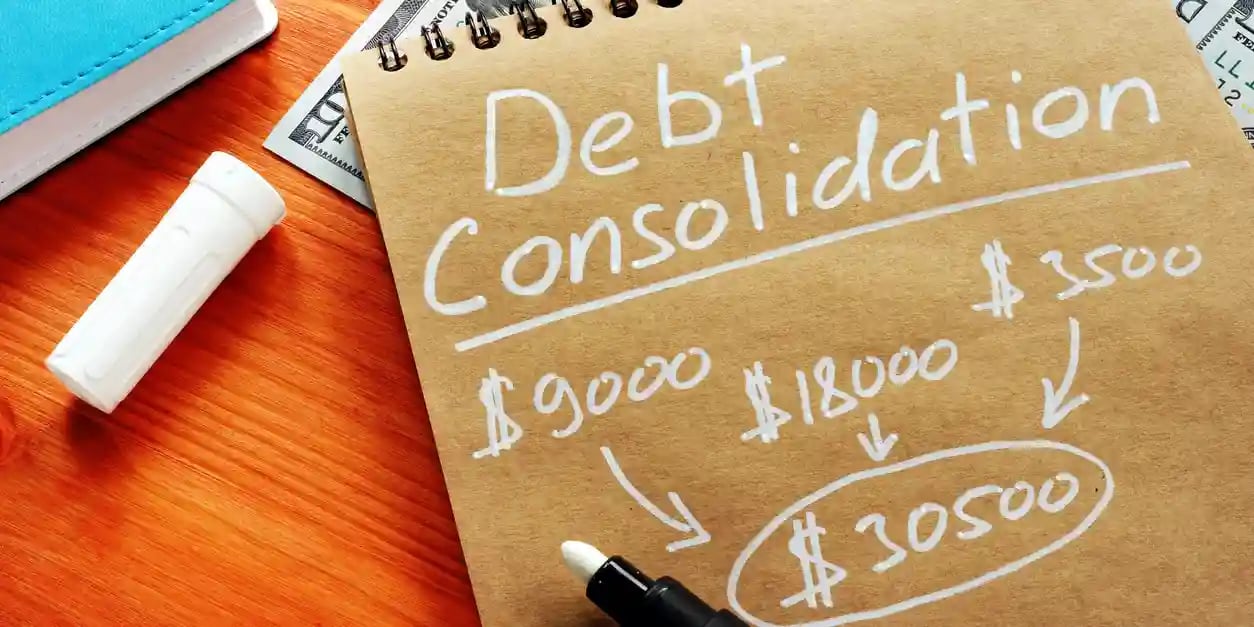

Financial advisors often recommend debt repayment when asked what an individual should prioritize in terms of financial health. COVID-19 changed this focus as many started to worry about their savings amidst such economic turmoil. That said, the goal of debt repayment remains a noble one. Indeed, virtually everyone should be focused on this as part of their overall financial strategy. How does debt repayment reduce the overall burden and stress of debt? We want to take a deep dive into this topic to see what kind of debt consolidation moves one should consider.

1. Consolidate Payments Down to One Monthly Payment

The biggest complaint from those with multiple credit cards is that they have various due dates. It is difficult to do this as most people are very busy and have plenty to worry about. Therefore, many get a debt consolidation loan that reduces those multiple payments.

Another advantage is that a debt consolidation loan tends to have a lower APR rate than credit cards, and that rate is fixed. CNBC.com explains the benefit here:

If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then repay the loan in monthly installments, usually with a lower interest rate than you were paying on your credit cards. Typically, personal loans are fixed-rate, meaning the APR is locked in for the lifetime of the loan, and you pay the same monthly amount until it's paid off. This is an advantage over credit cards, which have variable APRs that can go up and down.

Many find a knowable rate that doesn't change with the interest rate market highly useful. After all, this is the only way that we can reasonably prepare for debt repayment on a month-to-month basis with any level of consistency.

2. Comparison Shop Rates for Debt Consolidation

You should compare the various interest rates available before applying for a loan. You likely compare shop for everything you purchase at the grocery store. The choices that you make there are far less consequential than a debt consolidation loan. Besides that, there are literally hundreds of potential lenders who would very much like to earn your business. They have to compete with one another to provide the best rates and customer service in order to open up new accounts. It should hardly be any surprise then that they would want to do everything within their power to make your experience a positive one. Jumping at the first lender to offer you some funds is a recipe for disaster.

Consolidate and Celebrate

Celebrate your financial wins and know that you have a community that supports your goals! With a PrimeWay Debt Consolidation Loan, you get

Low Rates & Flexible Terms

Debt Consolidation Loan

8.99% APR* for up to 24 Months

Benefit of Credit Union Membership

Friendly, helpful customer service and a convenient online application.

3. Improve Your Credit Score

People who carry heavy debt loans are likely also carting around a sub-par credit score. This is because a big part of one's credit score is calculated based on the amount of credit utilization that they have. This is calculated by observing what percentage of the total amount of credit that one is offered is currently used. In other words, if one has a credit card with a maximum limit of $1,000, and they have used $600 of that limit, then they are at 60% credit utilization. The higher the credit utilization, the lower the credit score.

A debt consolidation loan takes the credit card balances that one carries and zeros them out. It replaces the debt under the consolidated loan structure. However, this is a much better option for the individual as it will lower their overall credit utilization. It might not happen instantly, but it should take effect rather quickly after one borrows the debt consolidation loan.

4. Set a Schedule

It is entirely possible to pay off the debt that one incurs from a debt consolidation loan early. There are no prepayment penalties on these loans (at least from any lender that is worth dealing with). Then, you can set up the payments to come out automatically from your bank account. You might even go so far as to set a payment schedule to meet. The advantage here, of course, is avoiding some additional fees and interest charges that come with carrying the debt long-term.

4 Debt Consolidation Moves That Can Improve Your Financial Well-Being

How does debt repayment reduce the overall burden and stress of debt? Learn more about what debt consolidation moves one should consider.

Learn More About Debt Consolidation

Many people are just swimming in high-interest credit card debt and other forms of debt that are clawing away at their monthly budget and making it impossible for them to live the life that they want to live. This sad state of affairs leaves many vulnerable, and it is no way to carry on. Instead, everyone should educate themselves on the debt consolidation options that are available to the masses. It can take a lot of stress off and make balancing the budget much easier.

The added benefit of an improved credit score is another element that people do not talk about nearly enough. Fortunately, all of this is available from a basket of different lenders who will at least consider applicants with all different kinds of credit scores. If you have been stressing your monthly debt payments, then there is no time like the present to get involved with debt consolidation.f you're burdened by high-interest credit card debt, you can uncomplicate your life by consolidating that debt with PrimeWay Credit Union. We are a credit union in Houston, Texas, that's dedicated to helping people navigate life's financial challenges and opportunities, so they can enjoy the financial freedom they deserve.

With our debt consolidation loan, you will be able to consolidate and save in simple steps.

Are you ready to achieve financial freedom with a debt consolidation loan but don't know where to start? Contact us today to get started.